UPI Scams

What is UPI?

Unified Payments Interface (UPI) is a peer-to-peer payments system in India that lets you use different bank accounts from one mobile app. It helps you send money, pay for things, and request money from others, all in one place. You can even schedule payments to happen later when it's convenient for you. Over time, it has become an integral part of how we handle payments in everyday life. Previous versions of IMPS or RTGS used to be overly complicated, especially for the elderly. UPI payments on the other hand, are simple, convenient and hassle-free.

What makes UPI special?

- Send money anytime: You can send money using your phone 24/7, all year round.

- One app for all banks: Use a single app to access and manage different bank accounts.

- Easy and secure payments: With just one click, you can make safe payments. The single click, 2-factor authentication makes it a reliable tool. A UPI ID as a virtual address is considerably easier to use than a bank account number, IFSC code, or a card number.

- Scan to pay: Pay by scanning a code with your phone's camera.

- No need for cash: You don’t have to worry about finding exact change, going to an ATM, or dealing with cash when you pay for deliveries.

- Pay merchants easily: You can pay stores or businesses using one app or directly inside other apps.

- Pay bills and more: You can pay utility bills, make payments at stores, and scan QR codes to pay easily.

- Give and collect money easily: Donate to charity, collect money from friends, or pay many people at once.

- Report issues easily: You can file a complaint directly from the app.

What’s a UPI scam?

UPI scam is basically stealing money from innocent people under false pretences. Fraudsters employ different tactics to fool people into making a transaction into the scammer's accounts. They accomplish this by tricking people into revealing their personal information such as UPI PIN, birthday, address, bank details, and Aadhaar information. This enables scammers to carry out illicit transactions.

Types of UPI scams

Scammers impersonate bank officials, police, or customer care representatives to lure people into sharing their sensitive information. Common tactics include creating a fake emergency, tricking people with promises of prize money, or claiming they need to fix bank accounts due to security risks or fraudulent activity. Victims are persuaded to share their personal information, such as bank or debit card details, OTPs and UPI PINs.

Scammers often send fake UPI payment screenshots to individuals, pretending the payment was sent by mistake. They then call the victim, urging them to return the money, creating a false sense of urgency to prevent careful verification. This tactic affects both merchants and individuals. In busy retail environments, scammers trick merchants into providing goods or services without actual payment using fake screenshots. Similarly, in cash-for-payment scams, fraudsters request cash urgently and present fake payment proofs as evidence of an online transfer.

A fraudster usually deceives the person into scanning a fake QR code with their phone, which redirects them to a fake e-commerce or bank website. The user is then asked to enter personal information, such as their name, bank details, or login credentials. Scammers use this information to steal money or commit identity fraud.

The age-old phishing scam involves sending fake emails to steal your personal and sensitive information. Once you enter your login credentials on the fake website, the scammers get your information right away and can use it to commit fraud.

Scammers can control your phone through screen-sharing apps and can easily make transactions without your permission. They can steal sensitive information like UPI PINs, OTPs, and other personal/ private details. It is therefore not advisable to download any app while you are on a call with an unknown person.

Cyber criminals often use malware to extract sensitive data of innocent users. It mostly reaches people’s devices through unsecured websites, fake apps, and emails attachments or links. Fraudsters can copy data, carry out financial transactions and even steal identities of unsuspecting individuals.

When scammers pull a scam, they need a safe place to keep the stolen money. For that, they use the accounts of innocent people to park the money and move when needed. That account becomes a money mule, a place from where fraudsters can transfer the money to other accounts. This makes it very hard for cyber police to trace the money. You can become a money mule by accepting fake job offers, loans or grants, or help a friend whose identity is stolen. In all the scenarios, an unsuspecting user receives the money willingly. They unknowingly help a scammer carry out their scam but never actually get to use the money.

SIM cloning or duplicating a SIM has become a common scam after OTP was mandated by banks. Once your SIM is cloned, it becomes easier for the scammers to get OTPs and change UPI PINs. Scammers can steal identities, bank details and take over your social media profiles. They can also demand money from your friends and relatives under false pretences.

Scammers are deceiving people into approving fake collection requests. It might look like a genuine payment you need to do but it goes to a fraudster's account. People end up approving such requests in a state of urgency, lack of awareness, or confusion. Scammers make it really hard for people to differentiate between a real payment request and a fraud one.

Modus Operandi of UPI scammers

Scammers usually call people and impersonate the representatives of a bank, telephone company, police, or hospital. They try to convince individuals by stating their full name and address and then ask for further verification of their phone number and date of birth. It’s an elaborate scheme where the scammers gain trust by sharing some of your information and seek to obtain other sensitive details that they currently don’t possess. Once they have it all, running a scam is an easy step from there.

Scammers usually fabricate a story involving either a technical issue with your bank or a false narrative convincing you that a loved one is in trouble. And to resolve these issues, they will ask for your personal details.

Once fraudsters are convinced that the victim is fully under their control, they will ask the person to download an app. These are usually screen-sharing apps that request various permissions. If you grant these permissions without reading them carefully, scammers will be able to fully control your phone and access sensitive information.

When the scammers have control over your phone, they can change your UPI PIN and initiate 2-factor authentication, making it impossible for you to gain access to your account.

How to prevent UPI scams

One of the simplest ways to protect yourself from scams is to know that no bank, police, or government authority will call and ask for your personal details. If an unknown caller is requesting this information for any reason, it is a scam.

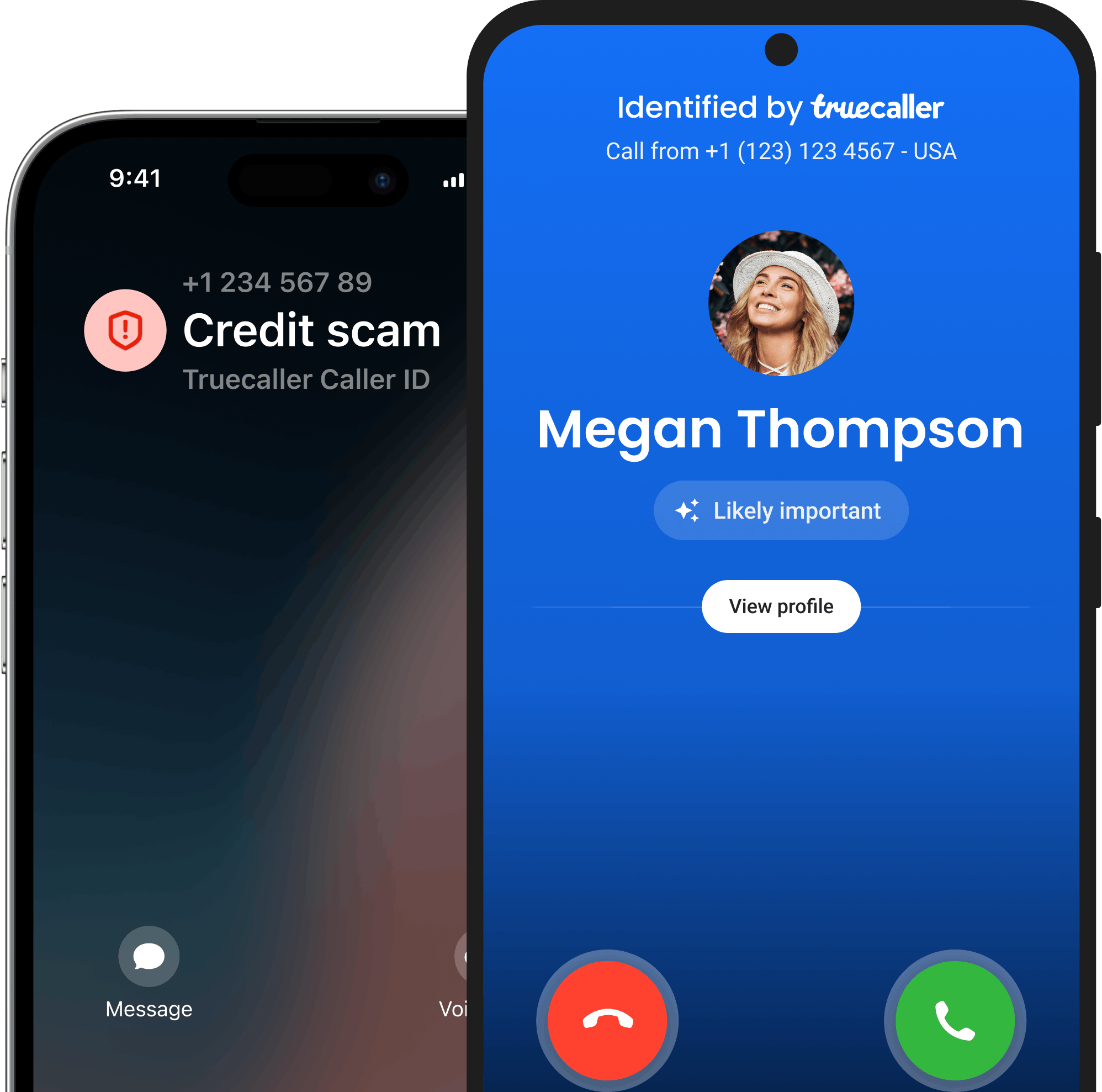

Truecaller lets you easily check unknown numbers. If it's a scam, the app will flag it.

Whether you're accepting or sending a payment request, take your time. Always double-check the details. Also, regularly checking your bank accounts can help avoid any unexpected surprises.

Scammers create fake apps that look similar to a bank app and upload them to Google Play Store. If you download a fake app by accident and allow permissions, it enables the scammers to steal your personal information. Before you download an app from Google Play Store (or other sources), take note of the name of the app's developer and if anything seems suspicious, don't download it.

Under no circumstances should you share your UPI PIN with anyone. Always use apps that require biometric authentication for accessing the UPI app. It’s also recommended to use a good antivirus to regularly check for malicious software.

Accessing UPI apps and bank apps over a public or password-less Wi-Fi network is a risky affair. It is one of the most common ways hackers access your data.

What victims of UPI scams should do

Here are the steps you need to take if you have fallen victim to a UPI scam:

- Do not engage with the scammer any further, stop all communications. Block the call and do not respond to emails or SMSs. Talking to the scammers will not get you your money back. In fact, they may fleece more money off you by luring you into another scam.

- If you have paid a scammer, contact your bank immediately, report it on the UPI app and NCPI (National Payments Corporation of India).

- Do not delete any communication details from your device. All of this is evidence that can help the cyber crime cell to trace your money. This includes transaction IDs, SMSs, and emails.

- Keep a track of your credit cards, credit reports, bank accounts, and messages from the bank. Check for any suspicious activity. Freezing your bank account for a while will help secure your money and discourage scammers from further attempts.

- The faster you report this, the better the chances of recovering lost money.

Where to report UPI scam

- File a cyber crime report on https://cybercrime.gov.in/ or contact Sanchar Saathi.

- Access the list of state wise nodal officers and their contact details here.

- For immediate assistance and guidance on cyber fraud, call 1930 (toll-free).

- Reporting the scam on Truecaller will save others from becoming a victim.

Protect yourself from UPI scams with Truecaller

Conclusion

UPI payments are secure and hassle-free if you follow certain guidelines. Be cautious of schemes that seem too good to be true, as well as lottery phone calls and emails. Avoid downloading apps from unauthorised platforms, and don’t click on random links from unknown senders. If someone is rushing you for a payment stating an emergency, it is most likely a scam. Remember, your bank and government authorities will never ask for your personal details. Keep your UPI PIN private and use apps with biometric authentication.